The phenomenon of “De-risking”

During the last years the AML regulations have become stricter, forcing the banks and payment institutions to pay closer attention to compliance. The harsh consequences of non-compliance, such as the annulment of operating licenses of institutions, the criminal prosecution against their executives, billion-dollar fines and the reputational risk has led to the phenomenon of “De-risking”. According to the European Banking Authority (EBA), “De-risking refers to a decision taken by firms to refuse, or to terminate, business relationships with some categories of customers that they associate with higher ML/TF risk.”.

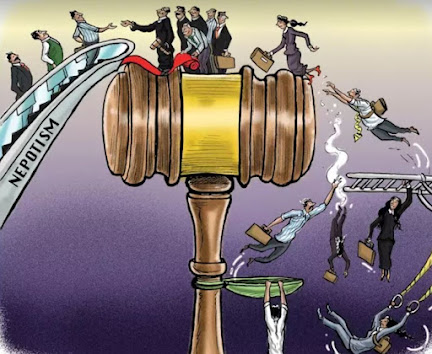

Ιn depth, it has been noticed instead of applying a risk based approach for each customer individually, in a comprehensive and proportionate basis, the banks and financial institutions tend to exit entire categories of customers and terminate relationships with high risk clients, such as residents of certain countries, PEPs, charities and certain type of businesses. Some of the factors driving de-risking are (a) the general regulatory guidance, containing broad definitions of acceptable risk, (b) the impression of the banks that it is safer to avoid high risk customers at all, rather than proceed to a case by case assessment and (c) cost concerns. More specifically, the last factor refers to the fact that the assessment and management of money laundering risk is associated with the need to have additional and properly trained staff, as well as technology upgrades, which is equivalent to extra compliance costs.

Even though the practice of de-risking has lowered the total risk appetite of the majority of banks and payment institutions, this “overzealous reaction to increased regulatory oversight” poses risks. Firstly, de-risking adversely affects charities and humanitarian organisations, while the inability to get humanitarian assistance to refugees or people stricken with natural disasters could have severe results. At the same time, de-risking undermines the right of access to payment systems by whole groups (people with low income, nationals of high risk countries etc). Last but not least, by pushing higher risk transactions out of the regulated system, the entities and individuals affected from de-risking turn to shadow banking systems, making the suspicious transactions no longer detected and monitored. As a result, de-risking is not a beneficial practice for the fight against money laundering, but a crucial turning point.

Coming to an end, we acknowledge that banks seek to comply with legal and regulatory requirements, but there is a need to carefully balance financial inclusion with the need to mitigate money laundering risk. Payment Institutions shall bear in mind that the application of a risk-based approach does not require firms to terminate business relationships with entire categories of customers and be ready to justify de-risking decisions to the regulators. The competent authorities, on the other hand, shall perform assessment of de-risking in their jurisdictions. Although, how can we eliminate the risks from de-risking within the financial system, when banks can be punished for having the wrong customers, but not for having no customers at all?

Comments

Post a Comment